jangkrik.ru

Market

How Do I Send Money To Someone

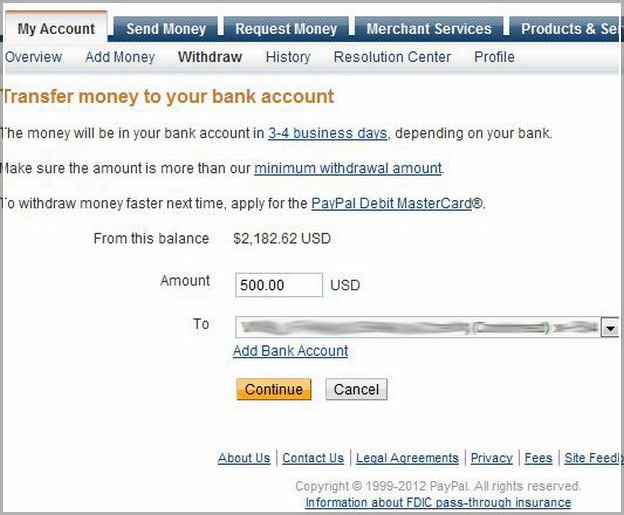

Enter the preferred email address or U.S. mobile number of the recipient. You can send money to almost anyone1 you know and trust with a bank account in the. How to Wire Money · 1. Choose a Wire Transfer Provider · 2. Provide the Transfer Details · 3. Review Terms and Conditions and Pay the Wire Transfer Fee · 4. Wait. We make it easy! In-store money transfers. Choose a destination. We service + countries & territories. Send with names you know. Trust MoneyGram, Ria &. Your recipient doesn't need to sign up to Remitly to receive money. However, the sender must create a Remitly account to send money. For more information, check. Use a money-transfer app. If you have the email or US mobile number of the recipient, you may be able to send money securely using an online service or app. To send money to someone in the mobile app, send an interac e-transfer. Note: You can select When the Interac eTransfer will be sent as well as Frequency. Go to Send. · Enter your recipient's name, PayPal username, email, or mobile number. · Enter the amount, choose the currency, and add a note if you'd like. . Quickly and securely pay your bills, transfer money, or repay other people. Transfer money between your accounts and between banks, schedule transfers or. All it takes to pay someone is their phone number, email, or $cashtag. You can even scan their QR code straight from the app. Keep track of your. Enter the preferred email address or U.S. mobile number of the recipient. You can send money to almost anyone1 you know and trust with a bank account in the. How to Wire Money · 1. Choose a Wire Transfer Provider · 2. Provide the Transfer Details · 3. Review Terms and Conditions and Pay the Wire Transfer Fee · 4. Wait. We make it easy! In-store money transfers. Choose a destination. We service + countries & territories. Send with names you know. Trust MoneyGram, Ria &. Your recipient doesn't need to sign up to Remitly to receive money. However, the sender must create a Remitly account to send money. For more information, check. Use a money-transfer app. If you have the email or US mobile number of the recipient, you may be able to send money securely using an online service or app. To send money to someone in the mobile app, send an interac e-transfer. Note: You can select When the Interac eTransfer will be sent as well as Frequency. Go to Send. · Enter your recipient's name, PayPal username, email, or mobile number. · Enter the amount, choose the currency, and add a note if you'd like. . Quickly and securely pay your bills, transfer money, or repay other people. Transfer money between your accounts and between banks, schedule transfers or. All it takes to pay someone is their phone number, email, or $cashtag. You can even scan their QR code straight from the app. Keep track of your.

A wire transfer is a method of transmitting money electronically between people or businesses in which no physical money is exchanged. The bank account number of the person you are sending money to. · The bank routing number (this is a nine-digit number that identifies the specific bank holding. Send money · Tap + New payment. · In the search bar, enter one of the following: Contact's name; Phone number; Email address · Select the contact you want to pay. You can send money to a person who doesn't have an account from the app if you have their email address or phone number. Cash App will send them a notification. Log in to your PayPal account. · Choose “Send & Request.” · Enter your recipient's name, PayPal username, email, or mobile number. · Enter the amount, choose the. Register and verify your free profile · Select where you want to transfer money to · Enter your recipient's details · Pay for your online money transfer securely. Send money to someone in prison. You can use this service to make a payment by Visa, Mastercard or Maestro debit card. Money usually takes less than 3 working. Zelle®: A fast and easy way to send money Whether you're paying the sitter, settling up on a group gift or paying for your part of the pizza, all you need is. You can usually initiate a bank-to-bank wire transfer in person at your bank or financial institution's local branch or through your online bank account. You can send money to someone without knowing their bank details. When setting up a transfer, we'll give you a link that you can share with your recipient. Now your money is on its way and can arrive in as little as a few minutes, up to four business days if the funds are sent from your bank account1. You and your. This lets you easily send money to someone else's account, which makes it a great way to transfer money to a student away at school or someone you pay often. 1. Go to 'Send' · 2. Choose where you want to send from · 3. Enter how much you'd like to transfer · 4. Let us know who you're sending money to · 5. Review the. Whether you're looking for how to make bank-to-bank transfers between your own accounts or how to transfer money to someone else's bank account, wire transfers. How do I send money to someone? · Log in to jangkrik.ru and navigate to Pay Bills and People, then select Pay People, and go to Send Money. · Enter the. 8 Low-Cost Ways to Transfer Money · Your Bank · Zelle · PayPal and Venmo · Western Union or MoneyGram · Physical Cash · Personal Checks · Bank Drafts, Money Orders. Fill out the name, address, and phone number of your receiver. Sending directly to someone's bank account? No problem. Just include their bank name and account. Tell us who you're paying. Tap Pay Anyone to find a friend or enter their $ChimeSign. You can also pay by email or phone # for someone who isn't on Chime. In most cases, I just opt for bank transfer. One client uses Deel as an intermediary, and that has worked quite well too. It's easy to transfer money. Move money between your U.S. Bank accounts – and to and from accounts at other banks. With U.S. Bank mobile and online banking.

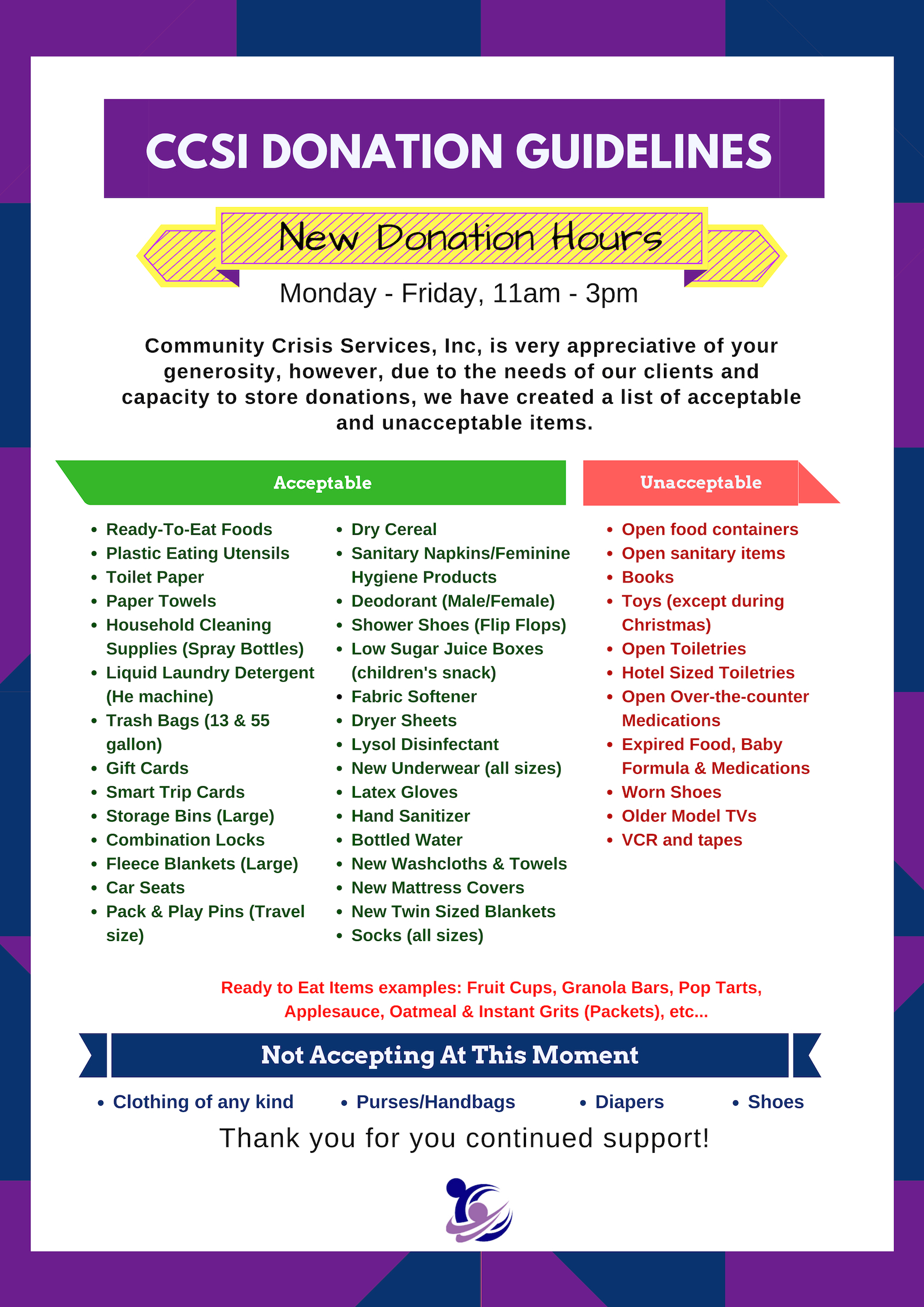

Donation Guidelines For Taxes

How much can you deduct for the gently used goods you donate to Goodwill? The IRS allows you to deduct fair market value for gently-used items. The quality of. For the tax year, you can generally deduct up to 60% of your adjusted gross income (AGI) in monetary gifts. In , the IRS temporarily allowed taxpayers. The 20rules require donors to itemize their deductions to claim any charitable contribution deductions and are limited to the AGI limit of 60%. You're also making a tax-deductible donation. How to place a value on your donation. The IRS requires donors to determine the value of their donations for tax. If you itemize your deductions, you may be able to deduct charitable contributions of money or property made to qualified organizations. Only donations actually. How much can you deduct for the gently used goods you donate to Goodwill? The IRS allows you to deduct fair market value for gently-used items. The quality of. Use the online donation receipt builder to track and keep important IRS guidelines for your tax return after donating to Goodwill. You'll receive a tax deduction in the year that the contribution is made (see rules for public charities in the chart above). When you donate cash an IRS-qualified (c)(3) public charity, you can generally deduct up to 60% of your adjusted gross income. How much can you deduct for the gently used goods you donate to Goodwill? The IRS allows you to deduct fair market value for gently-used items. The quality of. For the tax year, you can generally deduct up to 60% of your adjusted gross income (AGI) in monetary gifts. In , the IRS temporarily allowed taxpayers. The 20rules require donors to itemize their deductions to claim any charitable contribution deductions and are limited to the AGI limit of 60%. You're also making a tax-deductible donation. How to place a value on your donation. The IRS requires donors to determine the value of their donations for tax. If you itemize your deductions, you may be able to deduct charitable contributions of money or property made to qualified organizations. Only donations actually. How much can you deduct for the gently used goods you donate to Goodwill? The IRS allows you to deduct fair market value for gently-used items. The quality of. Use the online donation receipt builder to track and keep important IRS guidelines for your tax return after donating to Goodwill. You'll receive a tax deduction in the year that the contribution is made (see rules for public charities in the chart above). When you donate cash an IRS-qualified (c)(3) public charity, you can generally deduct up to 60% of your adjusted gross income.

Deductions for charitable donations generally cannot exceed 60% of your adjusted gross income (AGI), though in some cases, limits of 20%, 30%, or 50% may apply. Long-term appreciated assets—If you donate long-term appreciated assets like bonds, stocks or real estate to charity, you generally don't have to pay capital. Deduction limits for charitable donations: If the total amount of your itemized deductions exceeds the standard deductions above, in you will generally be. Keep in mind that IRS Form is only required when an in-kind donation exceeds $ fair market value. Should the fair market value of a single item, or. The Donation Value Guide below helps you determine the approximate tax-deductible value of some of the more commonly donated items. And a donor must obtain a written acknowledgment from the charity to substantiate the gift, although the acknowledgment will generally not assign a dollar value. donation. It is at Second Harvest's discretion, as per guidelines outlined by the CRA, as to whether tax receipts for food donations are issued. Non-cash charitable donations: Similar to cash donations, record requirements depend on the value of the gift. The Internal Revenue Service (IRS) considers. Charities must keep copies of all tax receipts for two years after the year for which the receipt was issued. For ten-year gifts and other gifts of enduring. Required Information · a statement saying that it is an official receipt for income tax purposes · the charity's BN (Business Registration Number) · name and. According to the Internal Revenue Service (IRS), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books, and so. The IRS allows taxpayers to deduct donations on their federal tax returns, but there are several rules and processes to navigate. Don't worry — we'll cover how. Charitable contribution requirements For your charitable contribution to be eligible for a deduction, the nonprofit organization you are donating to must be. Requirements and limitations for charitable tax deductions · If you donate property to certain charitable organizations, your deduction might be limited to 50%. 1. How much of my donation is tax deductible? When you donate to an IRS-recognized charity, you can typically deduct the donation on your tax return. The. You're also making a tax-deductible donation. How to place a value on your donation. The IRS requires donors to determine the value of their donations for tax. According to the Internal Revenue Service (IRS), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books, and so. A tax-deductible donation is a charitable contribution of money or goods to a qualified, tax-exempt organization, which may reduce the amount of federal income. If you surpass the charitable deduction limit for one year, you can carry-over that deduction for a maximum of five years. These increased limits, raised over. When you donate cash an IRS-qualified (c)(3) public charity, you can generally deduct up to 60% of your adjusted gross income.

Is Roof Leak Covered By Home Warranty

Homeowners insurance will cover roof leaks that result from a perilous event, such as an unexpected hailstorm or fire. However, it's common for home insurance. What is excluded from homeowners insurance coverage? · Flooding. Water damage from flooding is typically not covered and requires a separate flood insurance. Protect your roof with American Home Shield leak repair coverage. Up to $ per term for fast leak repairs. Available with Shield plans. Get a quote now! Your homeowners insurance may pay to repair or replace your roof under your policy's dwelling coverage, minus your deductible, if it was caused by a covered. If the cause of the leakage was negligence, poor maintenance, or faulty workmanship, you wouldn't be able to claim a leaking roof. However, if a natural. Homeowners insurance may cover roof damage, depending on what caused the damage. For instance, homeowners insurance may help cover the cost of repairs if hail. If your roof has been leaking for an extended period of time and parts of it are rotting from water damage, then no. Most insurance companies. Unfortunately, most home warranty coverage does not include roof replacement. However, it might offer some coverage for smaller repairs. Most home warranties exclude roofs on townhomes. $ likely won't cover a roof leak repair or replacement. Negotiate for the seller to handle. Homeowners insurance will cover roof leaks that result from a perilous event, such as an unexpected hailstorm or fire. However, it's common for home insurance. What is excluded from homeowners insurance coverage? · Flooding. Water damage from flooding is typically not covered and requires a separate flood insurance. Protect your roof with American Home Shield leak repair coverage. Up to $ per term for fast leak repairs. Available with Shield plans. Get a quote now! Your homeowners insurance may pay to repair or replace your roof under your policy's dwelling coverage, minus your deductible, if it was caused by a covered. If the cause of the leakage was negligence, poor maintenance, or faulty workmanship, you wouldn't be able to claim a leaking roof. However, if a natural. Homeowners insurance may cover roof damage, depending on what caused the damage. For instance, homeowners insurance may help cover the cost of repairs if hail. If your roof has been leaking for an extended period of time and parts of it are rotting from water damage, then no. Most insurance companies. Unfortunately, most home warranty coverage does not include roof replacement. However, it might offer some coverage for smaller repairs. Most home warranties exclude roofs on townhomes. $ likely won't cover a roof leak repair or replacement. Negotiate for the seller to handle.

Home warranty insurance will cover roof leaks if they are caused by falling trees or branches, other falling objects, windstorms, hail, extreme weather. Will A Home Warranty Cover A Roof Leak? When confronted with the dilemma of a roof that is leaking and having a home warranty, the initial concern for many. Home warranties are designed to cover the kinds of mechanical, plumbing and major appliance repairs that homeowner's insurance doesn't: clogged pipes, furnace. Does homeowners insurance cover water damage from leaking plumbing? Homeowners insurance may help cover damage caused by leaking plumbing if the leak is. Almost certainly not. Windstorm damage to your roof is something you would submit to your home owners insurance. If they find negligence on the. Your policy will not cover water damage from a leaking roof when a lack of maintenance or neglect to the roof caused the damage. This means that if you put off. HVAC systems are typically covered under home warranties. They may be included in a basic or upgraded plan or require an add on to your contract. However, it's. When a covered appliance or home system breaks from normal wear and tear, a First American home warranty handles the costs of replacement or repair. Call First. Roof Leak Repair close. APHW home warranties provide coverage for rolled roofing, asphalt shingles, and flashing from water leaks that occur during the. 5. Roof leaks When unwanted water is coming into your home, it seems like something that should be covered under the plumbing portion of your home warranty. If you are wondering if your home warranty will cover roof leaks, that is an answer that varies depending on what company you use for your warranty. When it. That said, a home warranty coverage will typically only cover roof leaks caused by regular wear and tear. Your homeowners insurance policy, not your home. While your Homeowners Insurance typically covers roof leaks resulting from natural disasters such as fire, hail, or wind (unless your policy has a wind or hail. Unfortunately, roof leaks are usually not covered by home warranties. However, some plans offer roof coverage as an add-on, while comprehensive plans like. Here's the general rule: Roof leaks are covered when they're caused by sudden, accidental events. You're generally covered if your roof leaks after a named. 1 Year Limited Roof Leak warranty coverage will protect you against unexpected breakdowns. This is a repair or replacement plan structured to offer you. Yes, most standard home insurance covers the cost of roof repairs due to roof leaks and other roof damage caused by a covered loss. However, roof damage. Get up to $1, in coverage for limited roof leak repairs in the Standard CRES Preferred Home Warranty Plan. This coverage limit applies to both our 12 and. In general, homeowner's insurance covers roof repairs for damages caused by an event (storm, hail, tree limbs falling, wind damage). But, a home warranty will provide coverage for both roof and basement leaks. Gutter cleaning. Home warranties are excellent for conveniently and affordably.

Gained 50 Pounds In A Month

You read that right, 50 LBS!!!! I hope this video was as real as it comes and it helped someone. Know you are NOT alone. For people who are overweight or obese, the guidelines translate to a weight gain of about 1/2 pound ( kilogram) a week in the second and third trimesters. Use a bigger plate · Use a bigger spoon · Eat when you are not hungry · Eat in dimly lite rooms · Eat in front of the TV · Drink your calories. Potential health risks of weight gain. If you have gained weight and your body mass index (BMI) is in the obesity range, losing weight can improve your health. Here's What I Learned From Losing 50 Pounds in 4 Months When dieting alone wasn't enough, cycling helped me lose 50 pounds in four months. Weight gain in menopause is caused by many factors. Getting enough sleep and exercise, and eating the right foods for your body can help avoid weight gain. So after these 6 months I never lost the weight at this point, my body was holding onto the fat and water weight for dear life. And my body continued to. M posts. Discover videos related to Gained 50 Pounds Fat on TikTok. See more videos about Losing 30 Pounds of Fat, I Lost 50 Lbs in 2 Months, Losing M posts. Discover videos related to Gained 50 Pounds on TikTok. See more videos about Pounds, 50 Lbs in 6 Months Women, Loses Pounds. You read that right, 50 LBS!!!! I hope this video was as real as it comes and it helped someone. Know you are NOT alone. For people who are overweight or obese, the guidelines translate to a weight gain of about 1/2 pound ( kilogram) a week in the second and third trimesters. Use a bigger plate · Use a bigger spoon · Eat when you are not hungry · Eat in dimly lite rooms · Eat in front of the TV · Drink your calories. Potential health risks of weight gain. If you have gained weight and your body mass index (BMI) is in the obesity range, losing weight can improve your health. Here's What I Learned From Losing 50 Pounds in 4 Months When dieting alone wasn't enough, cycling helped me lose 50 pounds in four months. Weight gain in menopause is caused by many factors. Getting enough sleep and exercise, and eating the right foods for your body can help avoid weight gain. So after these 6 months I never lost the weight at this point, my body was holding onto the fat and water weight for dear life. And my body continued to. M posts. Discover videos related to Gained 50 Pounds Fat on TikTok. See more videos about Losing 30 Pounds of Fat, I Lost 50 Lbs in 2 Months, Losing M posts. Discover videos related to Gained 50 Pounds on TikTok. See more videos about Pounds, 50 Lbs in 6 Months Women, Loses Pounds.

Many health care providers suggest women gain weight at the following rate: 1 to 4 pounds total during the first 3 months (first trimester); 2 to 4 pounds per. How I gained the weight! At one point in my career, I worked my way onto a small team helping lead the capture and execution of a major. Don't overestimate the power of exercise. Exercise is essential for losing and maintaining weight. In fact, a combination of cardio and resistance training can. Eat a high-protein, low-carbohydrate diet. There is evidence that a low-carbohydrate, high-protein diet is at least as effective for losing weight as a. Have a healthy snack between 3 and 4. Last meal before 8 pm. Drink water or black coffee between meals. Lose 20 pounds in the first month, 15 pounds in the. HOW I LOST 50 POUNDS IN 5 MONTHS & KEPT IT OFF FOR 3 YEARS | My Weight Loss Journey | Weight Loss Tips In this video, I explain how I lost. Need to reverse weight gain quickly? · Cut the carbs (and prioritize the right ones). · Make sure you're getting enough sleep. · Eliminate distractions while. month. Learn More. Discount. Choose a FREE PN program—when you We tend to think we eat less and burn more than we do—sometimes by as much as 50 percent. Twin Pregnancy: ; Healthy weight. BMI – , 17 – 25 kg / 37 – 54 lbs ; Overweight BMI 25 – , 14 – 23 kg / 31 – 50 lbs ; Obese BMI greater than 30, 11 –. Gaining 15 pounds of muscle in three months is difficult, let alone Training, eating and supplementing properly can help accelerate what is naturally a. Tips for losing weight after 50 years include getting enough sleep, taking regular short breaks at work, treating underlying conditions that might contribute. Reduce your daily calorie intake by about To lose one pound a week, you need to create a calorie deficit of about a day, or 3, a week. To lose Weight gain at menopause can be managed using healthy eating and exercise; HRT may also be beneficial. Children can rapidly gain weight due to several environmental, medical or physiological reasons. Since there are many possible triggers, it's best to speak with. gained over 50 pounds. In the past if I stopped soda I would lose weight. I I gained 40lbs in less than 3 months after I had it and have not. How I gained the weight! At one point in my career, I worked my way onto a small team helping lead the capture and execution of a major. Since hormones drive weight loss and gain, exercise and CICO play a minor factor. Losing weight on a low carb diet is 80% what I eat, 10%. You might only gain a few pounds over a year. But some people gain more weight, like 10 or 20 pounds in a few months. If you need to take the medicine for. You might only gain a few pounds over a year. But some people gain more weight, like 10 or 20 pounds in a few months. If you need to take the medicine for.

How To Choose An Ira Custodian

Self-directed IRA custodians are ideal for investors who crave more control over their retirement savings. Unlike traditional custodians who focus mainly on. If you plan to invest actively in stocks, bonds, ETFs, and mutual funds, a mutual fund can be a good choice for an IRA custodian. The brokerage acts as the. To find the best IRA custodian for your strategy, you must do a comparison in fees and services. Use this template to help you make an informed decision. Self-Directed IRA Highlights The Internal Revenue Code requires that a qualified custodian maintain custody of the assets in an IRA for the account owner. As an initial matter, a self-directed IRA custodian has a limited role as it relates to evaluating any investment. A custodian will only determine whether. Which one you choose (or qualify for) depends on your age, income, and financial goals. Savings IRAs from Bank of America and Investment IRAs from Merrill Edge®. Below are a few important questions that will help you identify the right custodian for your self-directed IRA. Forge Trust provides you with the control to select and direct your own IRA investments. With our custodial services and your self-directed IRA, you can decide. When finding a custodian for a self-directed IRA, look for expertise in the asset classes you want to invest in and a strong BBB rating. Self-directed IRA custodians are ideal for investors who crave more control over their retirement savings. Unlike traditional custodians who focus mainly on. If you plan to invest actively in stocks, bonds, ETFs, and mutual funds, a mutual fund can be a good choice for an IRA custodian. The brokerage acts as the. To find the best IRA custodian for your strategy, you must do a comparison in fees and services. Use this template to help you make an informed decision. Self-Directed IRA Highlights The Internal Revenue Code requires that a qualified custodian maintain custody of the assets in an IRA for the account owner. As an initial matter, a self-directed IRA custodian has a limited role as it relates to evaluating any investment. A custodian will only determine whether. Which one you choose (or qualify for) depends on your age, income, and financial goals. Savings IRAs from Bank of America and Investment IRAs from Merrill Edge®. Below are a few important questions that will help you identify the right custodian for your self-directed IRA. Forge Trust provides you with the control to select and direct your own IRA investments. With our custodial services and your self-directed IRA, you can decide. When finding a custodian for a self-directed IRA, look for expertise in the asset classes you want to invest in and a strong BBB rating.

Keep an eye out for custodians whose charter may restrict your investment options that can supplement your real estate properties. Remember that the IRA. IRA custodians often specialize in certain investment types. The investor should understand what type of asset classes the custodian specializes custody in, and. When choosing a Gold IRA Custodian, you should consider factors such as reputation, experience, fees, storage options, customer service, and investment options. What you need is a special type of custodian that accepts non-traditional investments and is not bound by the same rules as financial institutions that offer. 8 Questions to Assist You in Choosing a Real Estate IRA Custodian · Who is your primary regulator? · What are your investment options? · Do you provide any. Quest Trust IRA custodian grows your retirement savings with SDIRA options like real estate investing, Roth IRA, crypto & financial support. Keep an eye out for custodians whose charter may restrict your investment options that can supplement your real estate properties. Remember that the IRA. Self-directed IRA custodians are ideal for investors who crave more control over their retirement savings. Unlike traditional custodians who focus mainly on. You'll need to choose a financial institution to serve as trustee of the SIMPLE IRAs to hold each employee's/participant's retirement plan assets. These. It's important to consider a self-directed IRA custodian that has experience in the industry, knowledge, and a high level of service. To choose the best Self-Directed IRA custodian consider researching their client reviews, security measures, and fees, among other factors. A contribution to a custodial Roth IRA for Kids can be made if a minor has earned income during the year. Eligible income can include formal employment income. Open your IRA online quickly & easily. Move money directly from your bank to your new Vanguard IRA® electronically. You'll just need your bank account and. Variations of common IRA types include Inherited IRAs and Custodial IRAs. Choose between a Roth vs. Traditional IRA with our calculator. Questions? We. It's crucial to pick an IRA custodian who offers a broad array of investment options, low fees, quality customer service, and user-friendly digital platforms. There may be certain exclusions from the IRS or your chosen custodian. You are responsible for finding an investment for your self-directed account. Once you. Costs are an important consideration in selecting a gold IRA custodian, but they shouldn't be the only factor you consider. Consider the cost along with a. New Direction Trust Company is the industry leader that allows you to self-direct your IRA in alternative investments of your choice. FIND A SELF-DIRECTED IRA CUSTODIAN OR PROVIDER. When you choose to work with a RITA member, you know you're in experienced hands. Fill out the form below to.

Vodka Stock Price

Stock analysis for Vodka Brands Corp (VDKB:OTC US) including stock price, stock chart, company news, key statistics, fundamentals and company profile. See Grey Goose Vodka funding rounds, investors, investments, exits and more. Evaluate their financials based on Grey Goose Vodka's post-money valuation and. VDKB | Complete Vodka Brands Corp. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Early First Mate - Invest $ (minimum investment)+ within the first week and receive 2% bonus shares and have one breadfruit tree planted for the planet. You are able to invest through an entity such as a Trust if available to you. Questions regarding an exit strategy: As we are a start-up venture, the shares are. Stock; VDKB; Overview. VDKB. Vodka Brands Corp. Common Stock. Bid Price. Size. Size. Time. Time. ETRF, , >year. CDEL, , 03/ Vodka Brands Corp. VDKB (U.S.: OTC). AT CLOSE PM EDT 09/04/ $USD; %. Volume0. Volume0. 65 Day Avg Vol 1 Day Range - A high-level overview of Vodka Brands Corp (VDKB) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals. Discover real-time Vodka Brands Corp (VDKB) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Stock analysis for Vodka Brands Corp (VDKB:OTC US) including stock price, stock chart, company news, key statistics, fundamentals and company profile. See Grey Goose Vodka funding rounds, investors, investments, exits and more. Evaluate their financials based on Grey Goose Vodka's post-money valuation and. VDKB | Complete Vodka Brands Corp. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Early First Mate - Invest $ (minimum investment)+ within the first week and receive 2% bonus shares and have one breadfruit tree planted for the planet. You are able to invest through an entity such as a Trust if available to you. Questions regarding an exit strategy: As we are a start-up venture, the shares are. Stock; VDKB; Overview. VDKB. Vodka Brands Corp. Common Stock. Bid Price. Size. Size. Time. Time. ETRF, , >year. CDEL, , 03/ Vodka Brands Corp. VDKB (U.S.: OTC). AT CLOSE PM EDT 09/04/ $USD; %. Volume0. Volume0. 65 Day Avg Vol 1 Day Range - A high-level overview of Vodka Brands Corp (VDKB) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals. Discover real-time Vodka Brands Corp (VDKB) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions.

Vodka Brands OTCPK:VDKB Stock Report ; Last Price. US$ ; Market Cap. US$m ; 7D. % ; 1Y. % ; Updated. 04 Sep, Get the latest Vodka Brands Corp (VDKB) stock price quote with financials, statistics, dividends, charts and more. Assoc Alcohol Share Price: Find the latest news on Assoc Alcohol Stock Price. Get all the information on Assoc Alcohol with historic price charts for NSE. United Spirits Share Price - Get United Spirits Ltd LIVE BSE/NSE stock price with Performance, Fundamentals, Market Cap, Share holding, financial report. Get Vodka Brands Corp (VDKB:OTCPK) real-time stock quotes, news, price and financial information from CNBC. Diageo plc produces, distills, and markets alcoholic beverages. The Company offers a wide range of branded beverages, including vodkas, whiskeys, tequilas. US Stock MarketDetailed Quotes. VDKB VODKA BRANDS CORP. 15min Delay Close Jul 8 ET. %. Market CapM. P/E (TTM) High. Low. Find information about holding shares in Diageo including tools you can Ketel One Vodka · Seedlip. BACK. ESG Current Item · Spirit of Progress plan · Our. Its other popular alcoholic beverage brands include Svedka Vodka, Casa Noble Tequila, and High West Whiskey. It has a % stake in the cannabis company Canopy. Get Vodka Brands Corp (jangkrik.ru) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Vodka Brands (VDKB) Stock Price & Analysis ; Average Volume (3M) ; Market Cap. $M ; Enterprise Value$M ; Total Cash (Recent Filing)$K ; Total. What is the market cap of Vodka Brands? As of the previous close price of $, shares in Vodka Brands had a market capitalisation of $m. VDKB - Vodka Brands Corp Stock - Stock Price, Institutional Ownership, Shareholders (OTCPK). Vodka Brands Corp. analyst ratings, historical stock prices, earnings estimates & actuals. VDKB updated stock price target summary. Price Performance ; 1-Month. unch. on 06/04/ Period Open: %. on 05/15/ (%). since 04/25/24 ; 3-Month. +. 70cl bottle Price: € Price per liter: €. Delivery from wednesday Stock vodka. Vodka of very high quality, it is exceptional. Get Diageo PLC (DGE.L) real-time stock quotes, news, price and financial The Company's principal products include scotch whisky, other whisk(e)y, vodka. Access Trust Me Vodka's valuation and stock price. View secondary pricing information, VWAP and distribution waterfall. And seek potentially outsized returns. Find the best local price for Stock Prestige Vodka, Poland. Avg Price (ex-tax) $17 / ml. Find and shop from stores and merchants near you.

Credit Needed For Chase Freedom Unlimited

The Chase Freedom Unlimited card lets cardmembers earn 1% cashback on every purchase, 5% on travel, 3% on dining in or out, and 3% on drugstores. It offers a straight forward, % cash back rewards percentage that is automatic and helps you earn rewards fast. We've done extensive research. And this Chase. TPG recommends a credit score of at least to have a chance for acceptance. However, there have been anecdotal reports of scores in the low- to mids. Chase cards generally require a good or excellent credit score to be approved. That's at least a on the FICO scoring model. Note that the Chase Freedom Rise. View all credit card offers on jangkrik.ru and find your perfect credit However, credit score alone does not guarantee or imply approval for any credit offer. To have the best chance of approval for the Chase Freedom Unlmited, you'll generally need a good to excellent credit score ( or higher). However, keep in. Earn unlimited % or more on all purchases, like 3% on dining and drugstores and 5% on travel purchased through Chase TravelSM. Credit Needed Good / Excellent; Card Brand Visa®. Highlights. Click APPLY NOW to apply online; INTRO OFFER: Earn an additional % cash back on everything you. The Chase Unlimited Card recommends a credit score of + which is good to excellent credit. Chase also tends to market to prime rate customers. The Chase Freedom Unlimited card lets cardmembers earn 1% cashback on every purchase, 5% on travel, 3% on dining in or out, and 3% on drugstores. It offers a straight forward, % cash back rewards percentage that is automatic and helps you earn rewards fast. We've done extensive research. And this Chase. TPG recommends a credit score of at least to have a chance for acceptance. However, there have been anecdotal reports of scores in the low- to mids. Chase cards generally require a good or excellent credit score to be approved. That's at least a on the FICO scoring model. Note that the Chase Freedom Rise. View all credit card offers on jangkrik.ru and find your perfect credit However, credit score alone does not guarantee or imply approval for any credit offer. To have the best chance of approval for the Chase Freedom Unlmited, you'll generally need a good to excellent credit score ( or higher). However, keep in. Earn unlimited % or more on all purchases, like 3% on dining and drugstores and 5% on travel purchased through Chase TravelSM. Credit Needed Good / Excellent; Card Brand Visa®. Highlights. Click APPLY NOW to apply online; INTRO OFFER: Earn an additional % cash back on everything you. The Chase Unlimited Card recommends a credit score of + which is good to excellent credit. Chase also tends to market to prime rate customers.

In general, credit card applicants need good credit to qualify for the Chase Freedom Unlimited card, which is defined as a FICO credit score of or higher. Increase your chances of getting approved for Chase Freedom Rise® by having at least $ in any Chase checking or savings account before applying. APR. For a purchase to qualify for the 5% bonus Cash Back, the merchant must submit charges to your credit card by the last day of the relevant calendar quarter. Details · Start with a Credit Builder Account* that reports to all 3 credit bureaus. · Make at least 3 monthly payments on time, have $ or more in savings. Chase does not require a prior credit history to qualify for a Freedom Rise card. Something else that may help is opening a Chase checking account and. Most approved applicants had a credit score of or higher — but some cardholders report being approved with credit scores in the low- to mids. For example, if you use the Chase Sapphire Preferred, Chase Freedom Unlimited credit score is the credit-building Chase Freedom Rise. Most. Our rating: More information. Close Our writers, editors and industry experts score credit cards based on a variety of factors including card features. Key Features · 5% unlimited cash back on travel purchased through Chase Travel℠ · 3% on dining at restaurants, including takeout and eligible delivery services. Chase requires Good / Excellent credit (typically a or higher FICO Score) to be approved for the Chase Freedom Unlimited®. If you have a lower credit score. The card requires a good credit score, generally or higher. If you have a good credit score, a steady income, and comply with the Chase 5/24 rule, you. The Chase Freedom Unlimited® card offers the following benefits: Lyft: Through March , you can enjoy 5% cash back on qualifying Lyft rides. That's % cash. Learn about cashback cards that work for you with Chase Freedom, featuring cards from Freedom Unlimited, Freedom Flex, and Freedom Rise. Chase Credit Journey. Sign up for free to monitor your VantageScore credit score, get alerts of possible identity theft, and gain personalized insights into. The Chase Freedom Unlimited is a simple credit card earning at least % cash back on everything, but pair it with a Sapphire Reserve or Sapphire Preferred. Credit Needed. Excellent, Good · Intro Offer. Earn an extra % on everything you buy (on up to $20, spent in the first year) — worth up to $ cash back. If you don't have another Chase card that earns Chase points fear not! The Freedom Unlimited is still an excellent starter card, and you can always apply for. Chase will usually approve or deny you instantly when applying for a credit card online. Every card has its own approval requirements, but in general, you'll. Freedom Unlimited® card; Keep tabs on your credit health, Chase Credit Journey helps you monitor your credit with free access to your latest score, alerts. With the Chase Freedom Unlimited®, you get % cashback on all purchases. It also comes along with some standard credit cards benefits like auto rental.

Omg Crypto Price

OMG Network price today is $ with a hour trading volume of $ M, market cap of $ M, and market dominance of %. The OMG price increased. The current real-time price of OMGToken is $ For details on other leading cryptocurrencies, visit the following pages: Top cryptocurrencies on OKX. The current price is $ per OMG with a hour trading volume of $M. Currently, OMG Network is valued at % below its all time high of $ This. OMG Network price is $, up % in the last 24 hours, and the live market cap is $32,, It has circulating supply of ,, OMG coins and a. The live OMG Network price today is $ USD with a hour trading volume of $ USD. We update our OMG to USD price in real-time. According to our OMG Network price prediction, OMG is forecasted to trade within a price range of $ and $ next year. OMG Network will increase. The live price of OMG Network is $ per (OMG / USD) with a current market cap of $ M USD. hour trading volume is $ M USD. OMG to USD price is. Historical OMG Network price ; 24/08/, €, €4,,, €32,, ; 23/08/, €, €4,,, €30,, The price of OmiseGO (OMG) is $ today, as of Aug 26 a.m., with a hour trading volume of $M. Over the last 24 hours, the price has. OMG Network price today is $ with a hour trading volume of $ M, market cap of $ M, and market dominance of %. The OMG price increased. The current real-time price of OMGToken is $ For details on other leading cryptocurrencies, visit the following pages: Top cryptocurrencies on OKX. The current price is $ per OMG with a hour trading volume of $M. Currently, OMG Network is valued at % below its all time high of $ This. OMG Network price is $, up % in the last 24 hours, and the live market cap is $32,, It has circulating supply of ,, OMG coins and a. The live OMG Network price today is $ USD with a hour trading volume of $ USD. We update our OMG to USD price in real-time. According to our OMG Network price prediction, OMG is forecasted to trade within a price range of $ and $ next year. OMG Network will increase. The live price of OMG Network is $ per (OMG / USD) with a current market cap of $ M USD. hour trading volume is $ M USD. OMG to USD price is. Historical OMG Network price ; 24/08/, €, €4,,, €32,, ; 23/08/, €, €4,,, €30,, The price of OmiseGO (OMG) is $ today, as of Aug 26 a.m., with a hour trading volume of $M. Over the last 24 hours, the price has.

The OMG coin does hold the potential to be a profitable investment, with a maximum price to be around $, which will be reflected soon in the future price of. Convert OmiseGO to INR with the world's top cryptocurrency at the tap of a button. The current OmiseGO price in INR is ₹ We update our OMG to INR values. Seamlessly check the live price chart and swap OMG Network (OMG) for crypto, USD or other currency at the convenient exchange rate via an instant converter. Get acclimatised to crypto with zondacrypto Find out what tasks you can complete to claim a share of the ZND token pool we have specially prepared for you. The current OMG Network price is $ In the last 24 hours OMG Network price moved %. The current OMG to USD conversion rate is $ per OMG. The. The price of OMG Network (OMG) is $ today with a hour trading volume of $4,, This represents a % price increase in the. The current real time OMG Network price is $, and its trading volume is $5,, in the last 24 hours. OMG price has grew by % in the last day, and. The OMG Network is the value transfer network for ETH and ERC20 tokens. OMG Network & Other Cryptocurrencies. Bitcoinbtc. $59, %. Bitcoin Chart. OMG Network is a form of digital cryptocurrency, also referred to as OMG Coin. Use this page to follow the OMG Network price live, cryptocurrency news, OMG. OMG Network's current price is $ , it has increased +% over the past 24 hours. OMG Network's All Time High (ATH) of $ was reached on 7 Jan The current price of OmiseGo (OMG) is USD — it has risen % in the past 24 hours. Try placing this info into the context by checking out what coins. OMG Network (OMG) is worth $ today, which is a % decline from an hour ago and a % decline since yesterday. The value of OMG today is % lower. OMG Network USD (OMG-USD) ; Aug 14, , , , , ; Aug 13, , , , , The current price of 1 OMG is ₹ INR. Mudrex provides you the best OMG to INR conversion rates in real time. OMG to INR Chart (OMG/INR). 1 OMG. The current price of OMG Network is ₹ per OMG. With a circulating supply of ,, OMG, it means that OMG Network has a total market cap of ₹. The current OMG Network price is €. The price has changed by % in the past 24 hours on trading volume of €. The market rank of OMG. The OMG coin does hold the potential to be a profitable investment, with a maximum price to be around $, which will be reflected soon in the future price of. Omisego Price Statistics ₹ Cr. Trade Vol 24h. ₹46 Cr. Circulating Supply. ₹14 Cr. OMG. Trading Activity. 82% Buy. The current price of OmiseGo / USDT (OMG) is USDT — it has fallen −% in the past 24 hours. Try placing this info into the context by checking out. In the first year for which we have data, the OMG price closed at $ this is 3,% up from the open, the best year for OMG Network price was average.

Cd Vs Municipal Bond

:max_bytes(150000):strip_icc()/GettyImages-689019164-fb16a968ac1e44e69b1a7013180aba7b.jpg)

Municipal bonds are issued by state and local governments to fund public projects for building or improving things like schools, highways, sewers, airports and. CDs and bonds are both low-risk ways to grow your savings over time. Their interest rates are usually comparable, but CDs carry less risk. When bonds might be a better choice. You need the tax break. If you live in a state with an income tax, municipal bonds can offer tax breaks that CDs cannot. CDs are fdic insured, so they are safest · Bonds are rated aaa,aa,a,bbb,bb etc based on the states ability to pay and their financial conditions. Unlike Treasuries, CD's, and money market funds, tax free municipal bonds are often challenging for retail investors to purchase because there are tens of. Historically bonds pay better than CDs, but if you think about it, a CD is basically a bond issued issued by a bank and is usually FDIC insured. A CD is subject to federal and state taxes, whereas treasury bonds are only taxed federally. Municipal bonds are usually not federally taxed. Should I invest. If, however, you purchase a municipal bond in the secondary market at a discount to the revised issue price, you can be taxed as either a capital gain or. One metric we closely follow to gauge the attractiveness of highly rated munis is the muni-to-Treasury ratio, or the MOB (municipals over bonds) spread. It is. Municipal bonds are issued by state and local governments to fund public projects for building or improving things like schools, highways, sewers, airports and. CDs and bonds are both low-risk ways to grow your savings over time. Their interest rates are usually comparable, but CDs carry less risk. When bonds might be a better choice. You need the tax break. If you live in a state with an income tax, municipal bonds can offer tax breaks that CDs cannot. CDs are fdic insured, so they are safest · Bonds are rated aaa,aa,a,bbb,bb etc based on the states ability to pay and their financial conditions. Unlike Treasuries, CD's, and money market funds, tax free municipal bonds are often challenging for retail investors to purchase because there are tens of. Historically bonds pay better than CDs, but if you think about it, a CD is basically a bond issued issued by a bank and is usually FDIC insured. A CD is subject to federal and state taxes, whereas treasury bonds are only taxed federally. Municipal bonds are usually not federally taxed. Should I invest. If, however, you purchase a municipal bond in the secondary market at a discount to the revised issue price, you can be taxed as either a capital gain or. One metric we closely follow to gauge the attractiveness of highly rated munis is the muni-to-Treasury ratio, or the MOB (municipals over bonds) spread. It is.

How do I buy tax free state municipal bonds? Bonds issued by the State of New Hampshire may be purchased in the primary or secondary market from brokers, and in. Unlike CDs, municipal bonds are free from federal and, in some cases, state and local taxes. Due to differences in tax treatment, municipal bonds that provide federally tax-exempt interest income typically yield less than taxable bonds. Overall, bonds present a lower risk than CDs. This is because the federal government often backs bonds. Historically bonds pay better than CDs, but if you think about it, a CD is basically a bond issued issued by a bank and is usually FDIC insured. Municipal bonds, or muni bonds, are These funds can contain all of one type of bond (municipal bonds, for instance) or a combination of bond types. A major benefit of municipal bonds, or "munis," is that the interest they pay is generally exempt from federal income taxes. They're also generally exempt from. When interest rates go up, bond prices typically drop, and vice versa. Footnote 1 Income from investing in municipal bonds is generally exempt from federal and. Municipal bonds are issued by state and local governments to fund public projects for building or improving things like schools, highways, sewers, airports and. In general, municipal bonds fall into one of two categories—general obligation or revenue bonds. This categorization is based on the source of their. In general, municipal bonds fall into one of two categories—general obligation or revenue bonds. This categorization is based on the source of their. Historically, in the twelve months after CD rates peaked (dates shown below), indexes representing a diversified mix of short-term bonds, municipal bonds, a. CDs are fdic insured, so they are safest · Bonds are rated aaa,aa,a,bbb,bb etc based on the states ability to pay and their financial conditions. When bonds might be a better choice. You need the tax break. If you live in a state with an income tax, municipal bonds can offer tax breaks that CDs cannot. Though certificates of deposit (CDs) carry less risk, municipal bonds have tended to outperform them. How to Compare Municipal and Taxable Bonds. While your tax. The bonds are used to fund multifamily affordable housing or elderly housing projects in Wisconsin and WHEDA has the authority to issue its bonds or notes for. Historically, in the twelve months after CD rates peaked (dates shown below), indexes representing a diversified mix of short-term bonds, municipal bonds, a. Although the income from a municipal bond fund is exempt from federal tax, you may owe taxes on any capital gains realized through the fund's trading or through. Due to differences in tax treatment, municipal bonds that provide federally tax-exempt interest income typically yield less than taxable bonds. One metric we closely follow to gauge the attractiveness of highly rated munis is the muni-to-Treasury ratio, or the MOB (municipals over bonds) spread. It is.

Selling A House And Buying Another

A bridging loan can help if you've bought a new home before you've sold your old one. Instead of paying two mortgages, one for each property, you'll just. While selling a home within a year of purchase isn't ideal, you can technically sell your home any time after closing. How to Buy a House (While Selling Your Current One) · Negotiate the closing date. You found a buyer for your current home—whew! · Set up a rent-back agreement. If you buy first, you'll only have to move once. It may be a while until you know for sure what the final sale amount is, but until then a bridging loan can. Do You Pay Capital Gains Taxes When You Sell a Second Home? If one of the homes was primarily an investment, it's not set up to be the exemption-eligible home. In short, no – not if you need the funds from your sale in order to buy. Most sellers want a prospective buyer to be in a proceedable position and by having you. The process of selling a house and buying another in a different state doesn't have to be complicated, but it does depend on how you want the relocation to. Some buyers decide to sell their existing home first before making an offer on their next house. This approach allows you to shop for a new home knowing that. 1. Start With a Top Selling Real Estate Agent · 2. Be Smart About the Listing Price · 3. Fake it Til' You Make It · 4. Keep Up With Current. A bridging loan can help if you've bought a new home before you've sold your old one. Instead of paying two mortgages, one for each property, you'll just. While selling a home within a year of purchase isn't ideal, you can technically sell your home any time after closing. How to Buy a House (While Selling Your Current One) · Negotiate the closing date. You found a buyer for your current home—whew! · Set up a rent-back agreement. If you buy first, you'll only have to move once. It may be a while until you know for sure what the final sale amount is, but until then a bridging loan can. Do You Pay Capital Gains Taxes When You Sell a Second Home? If one of the homes was primarily an investment, it's not set up to be the exemption-eligible home. In short, no – not if you need the funds from your sale in order to buy. Most sellers want a prospective buyer to be in a proceedable position and by having you. The process of selling a house and buying another in a different state doesn't have to be complicated, but it does depend on how you want the relocation to. Some buyers decide to sell their existing home first before making an offer on their next house. This approach allows you to shop for a new home knowing that. 1. Start With a Top Selling Real Estate Agent · 2. Be Smart About the Listing Price · 3. Fake it Til' You Make It · 4. Keep Up With Current.

The process of selling a house and buying another in a different state doesn't have to be complicated, but it does depend on how you want the relocation to. Learn more about the process so you can determine if buying or selling your home privately is the ideal choice for you. When your home sells, you use the proceeds from the sale to pay off the bridge loan. It bridges the gap between the sales price of your new home and your new. What you need to know about selling and buying again · Paying for your current property and a new property at the same time will be costly. · You could sell your. Like a HELOC, in that it's based on available home equity but made to give buyers the capital to carry two mortgages, bridge loans are for those who have good. There's no doubt your life will be infinitely easier if you sell your existing home first, and then buy, even if it means you have to rent for a while until. This is mostly done where the profits of the sale of the current property you own, go towards the deposit or down payment on the second one. In most cases this. A concurrent closing is used for selling and buying homes at the same time. If you need to sell your home in order to buy another home, the fastest way is with. More often than not, people have to sell an existing home before they buy another. That's because mortgages are far from pocket change. One way to buy and sell property at the same time is to extend the settlement period by 3 to 6 months, but this only works if the other party agrees. If you. You can wait until you sell your current home. With this option you risk losing the new home to another buyer, but you may find one later you like even more. Thinking of buying & selling at the same time? Achieve the maximum price in the shortest time for the lowest fees with Auctioneera Full Estate Agency Service. When you're selling a house and buying another you'll need to make arrangements for the supply of electricity, gas, water and telephone service. Use our moving. There are three ways to sell your home and buy another home without having to move twice. Sometimes moving twice is a better option, but a lot of people really. Likewise, if circumstances arise where the buyers are no longer in competition with another buyer, the buyer is to be advised of that fact. Members of the. Thinking of buying & selling at the same time? Achieve the maximum price in the shortest time for the lowest fees with Auctioneera Full Estate Agency Service. No. There's no mandate that you need to have started the purchase process on a new home before you can sell your existing place. As described above, there are. If you sell your house before buying a new one, expecting to be able to buy quickly afterwards, you may be disappointed and instead have to rent for a time. Most buyers will also be in an emotional state. If you can remember that you are selling a piece of property as well as an image and a lifestyle, you'll be more. Do You Pay Capital Gains Taxes When You Sell a Second Home? If one of the homes was primarily an investment, it's not set up to be the exemption-eligible home.