jangkrik.ru

Overview

Disadvantages Of Etfs

The management fees applicable to ETFs mean that your return on investment will never exactly match the index it tracks. The buy and sell price of your shares. What is DRIP Investing? Harvest ETFs are set up for Distribution Reinvestment Program (DRIP). A DRIP reinvests income paid to unitholders by an ETF into that. 10 ETF Concerns That Investors Shouldn't Overlook · 1. Commissions and Expenses · 2. Underlying Fluctuations and Risks · 3. Low Liquidity · 4. Capital Gains. Commissions and Expenses. ETFs are traded much like stocks, which is one of the most significant benefits of these investments. · Underlying Fluctuations and. Intraday peaks/troughs. Thanks to the fact that ETFs trade like stocks, prices can fluctuate at extremely short notice, which can leave you vulnerable if you. Disadvantages of Exchange Traded Funds (ETFs) · Limited Diversification: Some ETFs may have limited exposure due to the number of securities in the underlying. Disadvantages of ETF Trading ETFs aren't free, despite having lower management fees than mutual funds. As ETFs are traded like stocks, investors can pay 8 USD. Disadvantages of ETFs · Tracking errors: Even though ETFs are designed to perform similarly to the index they track, sometimes “tracking errors” occur. Cons · Market or sector risk – the market or sector the ETF is tracking could fall in value. · Currency risk – if the ETF invests in international assets, you. The management fees applicable to ETFs mean that your return on investment will never exactly match the index it tracks. The buy and sell price of your shares. What is DRIP Investing? Harvest ETFs are set up for Distribution Reinvestment Program (DRIP). A DRIP reinvests income paid to unitholders by an ETF into that. 10 ETF Concerns That Investors Shouldn't Overlook · 1. Commissions and Expenses · 2. Underlying Fluctuations and Risks · 3. Low Liquidity · 4. Capital Gains. Commissions and Expenses. ETFs are traded much like stocks, which is one of the most significant benefits of these investments. · Underlying Fluctuations and. Intraday peaks/troughs. Thanks to the fact that ETFs trade like stocks, prices can fluctuate at extremely short notice, which can leave you vulnerable if you. Disadvantages of Exchange Traded Funds (ETFs) · Limited Diversification: Some ETFs may have limited exposure due to the number of securities in the underlying. Disadvantages of ETF Trading ETFs aren't free, despite having lower management fees than mutual funds. As ETFs are traded like stocks, investors can pay 8 USD. Disadvantages of ETFs · Tracking errors: Even though ETFs are designed to perform similarly to the index they track, sometimes “tracking errors” occur. Cons · Market or sector risk – the market or sector the ETF is tracking could fall in value. · Currency risk – if the ETF invests in international assets, you.

When considering investing in ETFs, it is important to consider their potential disadvantages. While ETFs offer many benefits, there are also some drawbacks. Although ETFs offer lower fees than some alternative investments, such as mutual funds, before investing, as with any investment, keeping track of costs is. Lower Dividend Yields. There are dividend-paying ETFs, but the yields may not be as high as those obtained by owning a high-yielding stock or group of stocks. ETFs are subject to market fluctuation and the risks of their underlying investments. ETFs are subject to management fees and other expenses. Since the role of fund managers is limited to managing the investment portfolio, ETFs carry relatively low fund management expenses. This results in ETFs. Investors seeking liquidity and low management expense ratios may get a lot less than they expect in Fixed Income Exchange Traded Funds (ETFs). Potentially lower returns: Since ETFs track a market index, they can't outperform the market unlike a well-chosen individual stock. Lower. ETFs can be an excellent tool in a well-rounded portfolio, providing ease, diversity, and cost efficiency when used wisely. Disadvantages of ETF. ETFs also come with their disadvantages when compared to other investments: Trading costs for ETFs tend to be higher than something like. Some ETFs have low trading volume. This can lead to either barring investors from selling them as quickly as possible or wider bid-ask spreads that further. ETFs are good for both novices and seasoned investors. They're generally less hazardous than buying individual equities, accessible through Robo-advisors and. Disadvantages of ETFs. ETFs must be purchased through a broker, and a brokerage commission must be paid when you buy shares of an ETF. An investor trading in. When you invest in a leveraged ETF, you increase the amount you may stand to lose if the investment fails to perform. With each trade you make, you may easily. Capital risk: like all investment products, the value of an ETF can go down as well as up. Not all ETFs are suitable for all investors. The price of the. What are the drawbacks of investing in ETFs? · Lack of control — Investors cannot directly control or influence which securities are included in the fund's. When you invest in a leveraged ETF, you increase the amount you may stand to lose if the investment fails to perform. With each trade you make, you may easily. When compared to investing directly in stocks, bonds, and commodities, the primary disadvantage of investing in ETFs is that you don't get to make any day-to-. Whether any particular feature is an advan- tage or disadvantage for you will depend on your unique circumstances—always be sure that the investment you are. Disadvantages of ETFs · Variety: While ETFs may help diversify a portfolio, they aren't necessarily diverse on their own. · Market instability: Over the last. While ETFs have several advantages, there are also some potential disadvantages that investors should be aware of, including the potential for tracking error.

Can You Switch Amex Cards

If you've kept the card open for at least 12 months, any unused rewards will transfer to the new card. Regardless of how long you've had the card open, all APRs. There is no reason why you couldn't hold both – we have a variety of both US and UK AmEx cards. I won't be surprised if Amex tightens a bit on this front. 1. Click Edit Account Information in the Common Actions menu. · 2. Click More/Edit option at the top of the account summary page. · 3. Click Edit to modify Card. Your account number will not change. However, the actual card number will. So when you receive the card, the numbers will appear different and. With the Amex Green Card, you'll earn 40, Membership Rewards® Points Plus, if you transfer your points to one of Amex's airline or hotel loyalty. By using this option, you can turn the welcome bonus from a single Amex card into a flight that normally costs thousands of dollars. For example, you can. Upgrade one of your existing Additional Gold Cardmembers or take out a Platinum Additional Card at no extra charge. Share key premium benefits like unlimited. To be eligible for a new Card in the country you are moving to, your existing Card must be issued by American Express, you must be the primary Cardholder, and. You can keep your original Member Since date on your new Card when you apply as a Card Member. Start experiencing the benefits of Card Membership today, if. If you've kept the card open for at least 12 months, any unused rewards will transfer to the new card. Regardless of how long you've had the card open, all APRs. There is no reason why you couldn't hold both – we have a variety of both US and UK AmEx cards. I won't be surprised if Amex tightens a bit on this front. 1. Click Edit Account Information in the Common Actions menu. · 2. Click More/Edit option at the top of the account summary page. · 3. Click Edit to modify Card. Your account number will not change. However, the actual card number will. So when you receive the card, the numbers will appear different and. With the Amex Green Card, you'll earn 40, Membership Rewards® Points Plus, if you transfer your points to one of Amex's airline or hotel loyalty. By using this option, you can turn the welcome bonus from a single Amex card into a flight that normally costs thousands of dollars. For example, you can. Upgrade one of your existing Additional Gold Cardmembers or take out a Platinum Additional Card at no extra charge. Share key premium benefits like unlimited. To be eligible for a new Card in the country you are moving to, your existing Card must be issued by American Express, you must be the primary Cardholder, and. You can keep your original Member Since date on your new Card when you apply as a Card Member. Start experiencing the benefits of Card Membership today, if.

Delta SkyMiles Business Amex Card Benefits. Your business expenses can get more rewarding with Miles on everyday purchases. With every Delta SkyMiles Business. Annual fee of $ No foreign transaction fees from American Express when using your Card. · More Ways to Pay. You're in control with more ways to pay. You can. How to Do a Balance Transfer. Learn how you can move your current credit card balance to a Navy Federal card to consolidate debt and potentially lower payments. If you're currently at the 5 Amex credit card limit and you want to open a new Amex credit card, you'll have to call in and close an account in order to open a. Learn about the different types of credit cards available. Whether you want to collect cash back or enjoy travel benefits, American Express has the card for. However, there are two Amex cards where you can get a extra sign-up bonuses, even if you've had a card in your name in the last two years. The catch. Select your preferred Card from our Personal Card or Business Card page. · Click to apply online for your chosen Card. · Please acknowledge that you are an. Amex Global Transfer lets you “take your credit card with you to a new country.” Specifically, you can get approved for an American Express credit card based on. How to make the most out of your Amex card. Read more: The best rewards credit cards. What is American Express? American Express, whose name is frequently. If you do not have your Card in possession, then you will need to contact us by phone to request a new Card. From the Account home page, you can toggle between Cards by clicking the Card Amex Bank of Canada, P.O. Box , Station F, Toronto, ON M1W 3W7. Explore a wide range of Amex credit cards, including cashback and Avios travel cards. Learn how to choose a credit card to suit your needs. Apply today. Delta Amex credit card details. Here's a breakdown of each card so you can see how they compare: Delta Gold Amex. Delta SkyMiles® Gold American Express. Just call them and explain you no longer wish to pay for the card, and they will switch it to a different amex card with a lower or no fee. If you do not wish to receive the Amex Benefit, please call the number on the back of your Card. If you do not see the Amex Benefit in your Uber Cash balance by. You can visit your Account Center to activate online today or dial the number on the back of your card. Please have your new card and information ready. You'll. This means all eligible charges made on your account will automatically be added to your Pay Over Time balance. You can change or view your Pay Over Time. If you accept an upgrade offer, you may continue to use your Macy's Credit Card until your new Macy's American Express® Card arrives. Once you receive your new. Your Account number will stay the same. By applying for this Upgrade, you request that any existing balance on your British Airways American Express Credit Card.

Scss Tutorial

In this SCSS tutorial, we're going to create a minimal theme and use SCSS to give our CSS programming some superpowers. Sass Tutorial for Beginners - Learn SCSS - Sass Crash Course - #21 - Mixins With Arguments, SASS, Karl Hadwen. Sass adds Variables, Nesting, Partials, Mixins, Extend/Inheritance, and Operators. Some of these are things that programming languages tend to have. Explore this online scss tutorial sandbox and experiment with it yourself using our interactive online playground. You can use it as a template to jumpstart. Help, I'm stuck! jangkrik.ru CSS Editor. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 +. enter. { /* Styles would go here. */ }. SCSS, instead of extending SCSS in Ruby: @function make-greener($value) Thank you very much for this helpful tutorial. And I am learning such kind. I'm interested in upskilling my css with either Sass or SCSS. However I'm not sure where exactly to go to find good learning resources. Any help would be. There is no use to learn SCSS programming without learning CSS Styles. Hence, CSS is the key part to implement SCSS coding features. Start learning the SASS. Learn SASS/SCSS tutorial. This SASS/SCSS tutorial covers SASS syntax, features, various at-rules like @use, @forward in detail along with code example. In this SCSS tutorial, we're going to create a minimal theme and use SCSS to give our CSS programming some superpowers. Sass Tutorial for Beginners - Learn SCSS - Sass Crash Course - #21 - Mixins With Arguments, SASS, Karl Hadwen. Sass adds Variables, Nesting, Partials, Mixins, Extend/Inheritance, and Operators. Some of these are things that programming languages tend to have. Explore this online scss tutorial sandbox and experiment with it yourself using our interactive online playground. You can use it as a template to jumpstart. Help, I'm stuck! jangkrik.ru CSS Editor. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 +. enter. { /* Styles would go here. */ }. SCSS, instead of extending SCSS in Ruby: @function make-greener($value) Thank you very much for this helpful tutorial. And I am learning such kind. I'm interested in upskilling my css with either Sass or SCSS. However I'm not sure where exactly to go to find good learning resources. Any help would be. There is no use to learn SCSS programming without learning CSS Styles. Hence, CSS is the key part to implement SCSS coding features. Start learning the SASS. Learn SASS/SCSS tutorial. This SASS/SCSS tutorial covers SASS syntax, features, various at-rules like @use, @forward in detail along with code example.

If you're looking for an introduction to Sass, check out the tutorial. If you want to look up a built-in Sass function, look no further than the built-in. 8 videosLast updated on Oct 30, Play all · Shuffle · · SASS/SCSS Tutorial #1 - Getting Started and Installing Prepros. Omerko. In this tutorial we learn the basics of Sass and SCSS and the key differences in their syntax when defining scope and terminating statements. Friendly tutorials for developers. Focus on React, CSS, Animation, and more! SASS tutorial provides basic and advanced concepts of SASS. Our SASS/SCSS tutorial is designed for beginners and professionals. SASS is an extension of CSS. It. Less extends CSS with dynamic behavior such as variables, mixins, operations and functions. Less runs on both the server-side (with jangkrik.ru and Rhino) or. CSS Grid Tutorial · Bootstrap Grid Tutorial. Typography. CSS Fonts and Text sass --watch scss:css >>> Sass is watching for changes. Press Ctrl-C to. Learn Sass (Syntactically Awesome Style Sheets). Sass is an extension to CSS. It doesn't really change what CSS can do, you won't suddenly be able to use. Utilize our source Sass files to take advantage of variables, maps, mixins, and functions to help you build faster and customize your project. Sass has 2 syntaxes available. The difference between Sass and SCSS is quite subtle. Remember that: We're actually going to write SCSS but still call it Sass. Sass Tutorial - SASS (Syntactically Awesome Stylesheet) is a CSS pre-processor, which helps to reduce repetition with CSS and saves time. CSS is the language we use to style an HTML document. CSS describes how HTML elements should be displayed. This tutorial will teach you CSS from basic to. This Sass tutorial explains what Sass is, how to install it, and how to use it. This tutorial consists of the following lessons. We suggest using the full import stack from our jangkrik.ru file as your starting point. Variable defaults. Every Sass variable in Bootstrap includes the! Explore this online scss tutorial sandbox and experiment with it yourself using our interactive online playground. You can use it as a template to jumpstart. Sass is the most mature, stable, and powerful professional grade CSS extension language in the world. All course files for the Complete Sass Tutorial on the Net Ninja YouTube channel. - iamshaunjp/complete-sass-tutorial. The following procedure covers importing a CSS file from a ThingWorx repository. The file applies animation and opacity changes to the Button widgets within. There is no use to learn SCSS programming without learning CSS Styles. Hence, CSS is the key part to implement SCSS coding features. Start learning the SASS. In this Sass/SCSS tutorial we learn how to control the flow of our script and repeat sections of code with loops.

Debit Spread Option

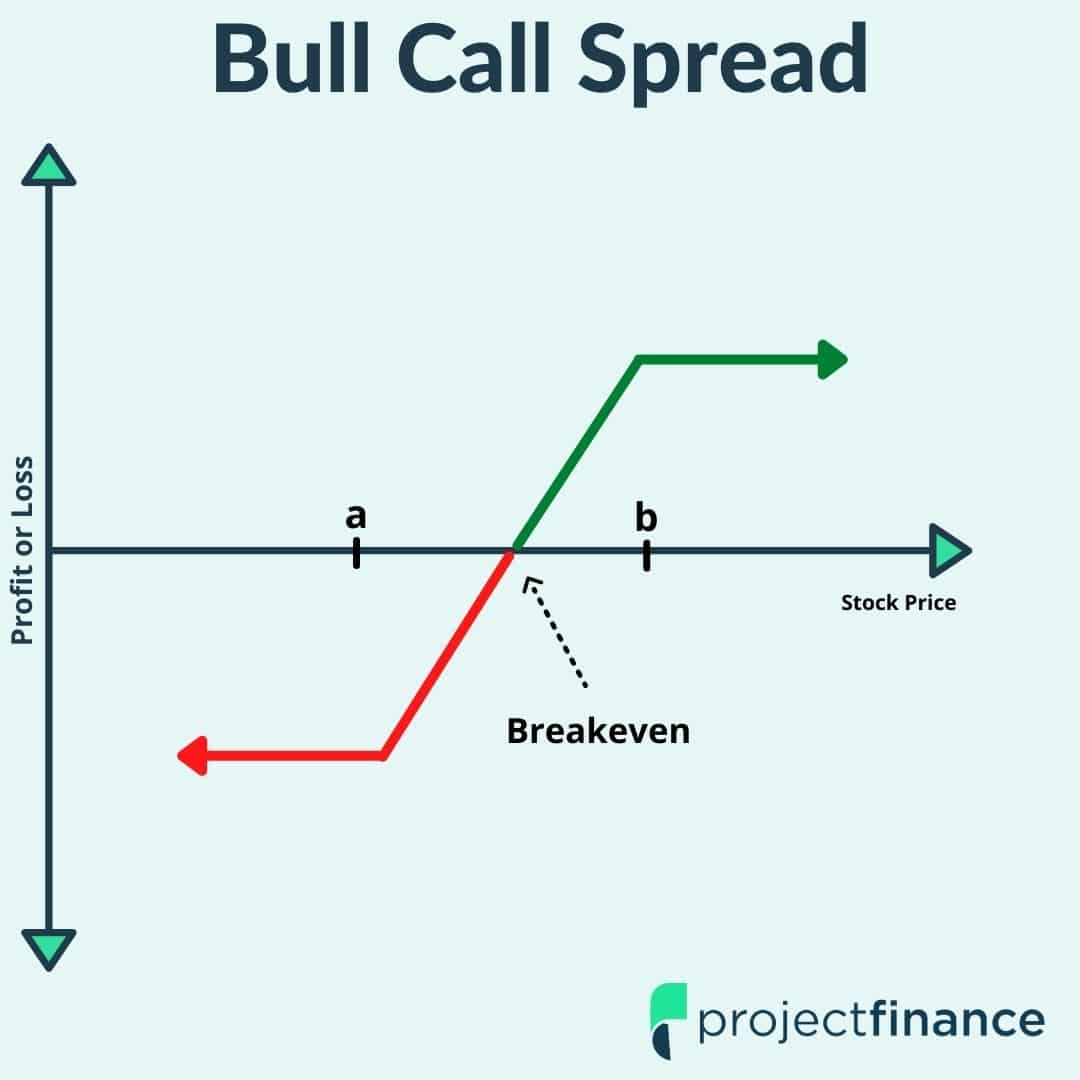

A Debit Put Spread, also known as a Bear Put Spread, is a strategy that involves buying a put option and then selling a put option at a lower strike (deeper out. Bull call trading · Options contracts: You buy 1 XYZ October 35 call (long call) at $, paying $ ($ x shares). · Cost: Your total cost, or debit. Debit spreads are a popular options trading strategy that involves buying and selling options contracts at different strike prices to create a net debit pos. A debit spread is a strategic move in options trading that involves two simultaneous actions: the purchase and sale of two options contracts. a call debit spread costs money to place because the option you sell is less valuable than the option you buy. Why would Jim choose a trade that costs money. A debit spread involves buying and selling options that result in an initial net cost or debit, targeting price movement in one particular direction. In. The term Debit Spread refers to any spread in which the trader/investor is required to outlay net premium in order to initiate the position. A debit spread is only created when you buy and sell different options contracts on the same underlying security. Bull Call Spread (Debit Call Spread). This strategy consists of buying one call option and selling another at a higher strike price to help pay the cost. A Debit Put Spread, also known as a Bear Put Spread, is a strategy that involves buying a put option and then selling a put option at a lower strike (deeper out. Bull call trading · Options contracts: You buy 1 XYZ October 35 call (long call) at $, paying $ ($ x shares). · Cost: Your total cost, or debit. Debit spreads are a popular options trading strategy that involves buying and selling options contracts at different strike prices to create a net debit pos. A debit spread is a strategic move in options trading that involves two simultaneous actions: the purchase and sale of two options contracts. a call debit spread costs money to place because the option you sell is less valuable than the option you buy. Why would Jim choose a trade that costs money. A debit spread involves buying and selling options that result in an initial net cost or debit, targeting price movement in one particular direction. In. The term Debit Spread refers to any spread in which the trader/investor is required to outlay net premium in order to initiate the position. A debit spread is only created when you buy and sell different options contracts on the same underlying security. Bull Call Spread (Debit Call Spread). This strategy consists of buying one call option and selling another at a higher strike price to help pay the cost.

A bull call spread is established for a net debit (or net cost) and profits as the underlying stock rises in price. Profit is limited if the stock price rises. A bullish vertical spread strategy which has limited risk and reward. It combines a long and short call which caps the upside, but also the downside. The term debit spread refers to an options strategy where the premiums received are less than those paid. Debit spreads result in funds being debited to the. For our wide call debit spread, the max loss is 50 minus $15, or $ Multiplying that by , since each option contract is shares of stock, our real. A debit spread involves purchasing a high-premium option while selling a low-premium option in the same class or of the same security, resulting in a debit from. The investor bought the long call for $8 and sold the short call for $4, creating a net debit (purchase) of $4, or $ overall ($4 x shares). This step. Debit spreads are options positions created by buying more expensive options contracts and simultaneously writing cheaper options contracts. A bear put debit spread is entered when the buyer believes the underlying asset price will decrease before the expiration date. Bear put spreads are also known. A debit spread involves simultaneous buying and selling calls or puts with different strike prices and the same expiration. This is known as a debit spread. Option spreads also allow you to collect a premium without having to sell a naked option, which carries unlimited risk. This is. A debit spread involves buying and selling options of the same type (call or put) with the same expiration date but different strike prices. In finance, a debit spread, a.k.a. net debit spread, results when an investor simultaneously buys an option with a higher premium and sells an option with a. Bull Call Debit Spreads Screener helps find the best bull call spreads with a high theoretical return. A bull call spread is a debit spread created by. When setting up a call debit spread, the long call is worth more than the short call, resulting in a net debit when establishing. Selling a call at a higher. A Bear Put Debit Spread is a risk defined and limited profit strategy. The max profit achievable is greater than the max loss. The maximum profit is achieved. Buy a call close to at the money or slightly in the money and sell a higher strike call and the spread MUST be purchased for less than 50% of. debit spread: In an option strategy, a debit spread is one that has a net debit (upfront cost) paid for long options. This means that there is an upfront. A trader who wants to speculate on an increase in price with a neutral to small increase in volatility can **buy a Call Debit Spread Option Strategies Details. A vertical debit spread is a defined risk, directional options trading strategy where we buy an option that we want to increase in value. A debit call spread is a very common spread to use with a bullish outlook. You are expecting a move to the upside, but by selling the out-of-the-money call you.